Mortgage interest tax deduction 2023 calculator

Estimate your tax refund and where you stand Get started. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Mortgage Calculator Script Free Mortgage Calculator Widget

You have until April 15 2023 to claim your 2019 tax.

. In 2021 and 2022 this deduction cannot exceed 10000. This is due the life of the loan unless. This calculator is integrated with a W-4 Form Tax withholding feature.

Only certain taxpayers are eligible. Before you FileIT your 2019 Return use our 2019 Tax Calculator to estimate your 2019 Tax Refund or Taxes Owed. Easily calculate your tax rate to make smart.

Married couples have the option to file jointly or separately on their federal income tax returns. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Specifically you can deduct home mortgage interest on up to 750000 of mortgage debt property taxes and mortgage insurance.

It may also include any points mortgage insurance premiums and real estate taxes you paid through your mortgage servicer. Suppose you took on the debt before December 15 th. Home Mortgage Interest Form 1098.

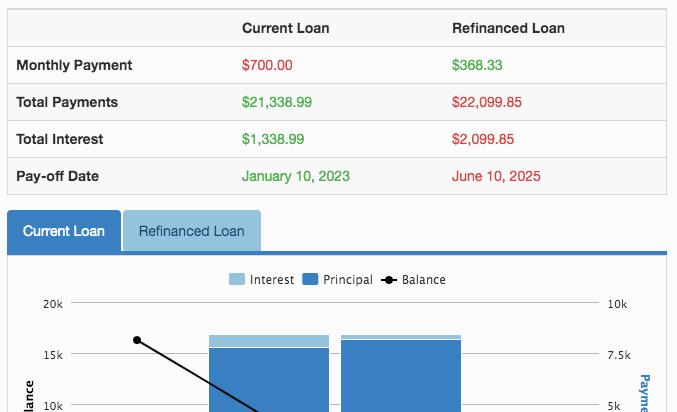

In that case the home equity loan deduction could be taken on up to a million dollars worth of qualified loans for married couples filing jointly and half that. Compare your mortgage interest points and mortgage insurance premiums to your standard deduction. Amend or change an accepted IRS Tax Return by completing a IRS Tax Amendment.

2023 to 80 2024 to 60 2025 to 40 and. The HR Block tax calculator 2022 is available online for free to estimate your tax refund. Given that this tool comes in handy we wanted to break down the HR Block Tax Calculators process and provide a little education on how the HR Block Tax.

If you pay either type of property tax claiming. 2022 Marginal Tax Rates Calculator. Is there a limit to the amount I can deduct.

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. In the vast majority of cases its best for married couples to file jointly but there may be a few instances when its better to submit separate. A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023.

Form 4952 Investment Interest Expense Deduction Form 8889 Health Savings Accounts HSAs Form 4684 Casualties and Thefts. Real Estate Taxes You Paid. IT is Income Taxes.

That means the status was heading to junk. Temporary 100 deduction of the full meal portion of a per diem rate or allowance. Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018.

Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return. Interest on up to 750000 in mortgage debt is tax deductible provided the mortgage debt is obtained via origination debt or the debt is taken on to build or substantially improve the dwelling. Situations covered assuming no added tax complexity.

Interest expenses on HELOC and home. If the total is larger than your. A similar plunge to the last bubble would wipe out 11 trillion of real wealth.

Most BTL deductions are the run-of-the-mill variety above including several others like investment interest or tax preparation fees. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. Taxpayers who live in states that dont have an income tax are probably better off using their sales tax for the deduction.

The last bubble wiped out 61 trillion which the US Inflation Calculator says would be worth 78 trillion today. You can claim a deduction for real estate taxes paid as long as they are an accurate representation of the property value. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

See State Tax Return Amendments. 2021 Tax Calculator Exit. If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill.

Access IRS back tax previous year calculators tax forms and tools. We also offer ones covering. A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023.

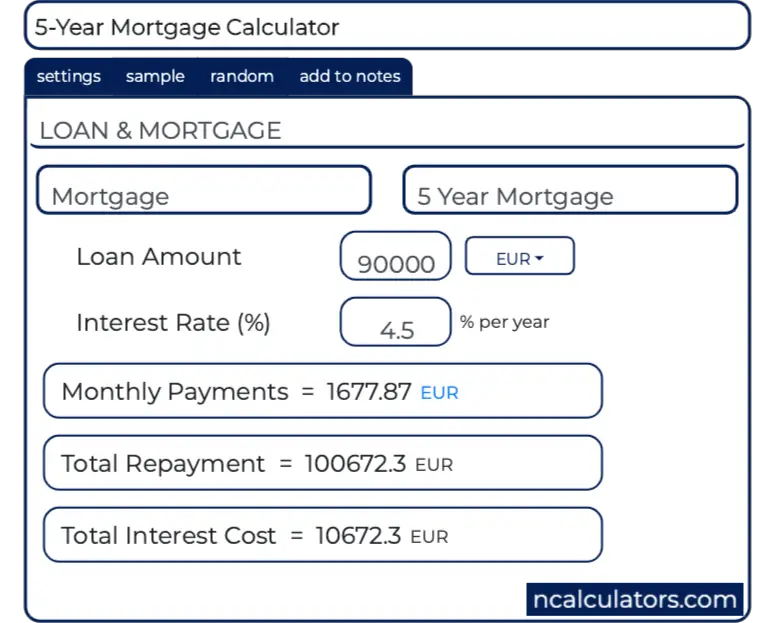

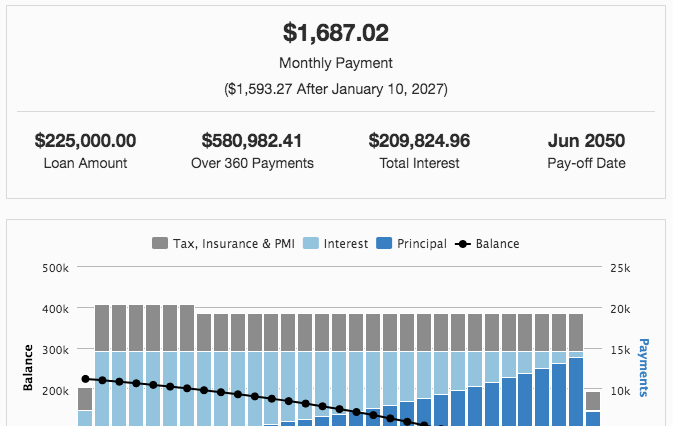

Annual mortgage insurance premium MIP costs 085 of the loan amount per year split up into 12 installments and paid monthly with the mortgage payment. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. As the year ends many folks start to look at their taxes and assess how much money they might be getting back in their tax refund. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. One week ago MBS mortgage backed securities went to no bid. Student loan interest deduction More Important Details and Disclosures.

The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together. Based on the Information you entered on this 2019 Tax Calculator you may need the following 2019 Tax Year IRS Tax Forms to complete your 2019 IRS Income Tax Return. This calculator is for the 2022 tax year due April 17 2023.

Form 1098 shows the amount of mortgage interest you paid during the previous year. See 50 Limit in chapter 2 for more information. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers. This happened before in 2008.

Calculate Your 2023 Tax Refund. This is an amount that you deduct right off the top just for being a living breathing tax-paying US. Mortgage Interest Statement.

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. The cap on this tax credit is 2000 per year if the certificate credit rate exceeds 20. The deduction applies to interest paid on home equity loans mortgages mortgage refinancing and home equity lines of credit.

It provides a 20 mortgage interest credit of up to 20 of interest payments. The size of the credit does depend on the area of the country you happen to live in. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

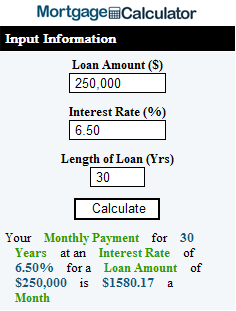

Mortgage Calculator

Mortgage Interest Calculator Cheap Sale 55 Off Www Wtashows Com

Refinance Mortgage Calculator Online 52 Off Www Wtashows Com

Mortgage Amortization Calculator Crown Org

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator

Extra Payment Mortgage Calculator For Excel

Home Affordability Calculator For Excel

Home Ownership Expense Calculator What Can You Afford

Mortgage Calculators From Security First Mortgage Funding Llc

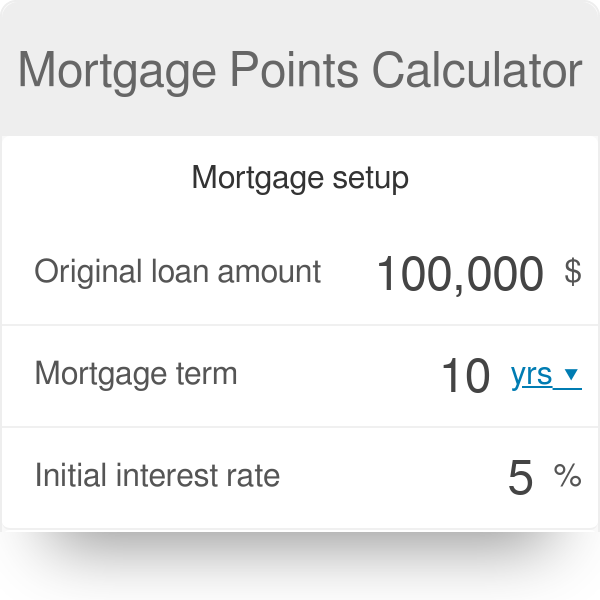

Mortgage Points Calculator

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Mortgage Recast Calculator To Calculate Reduced Payment Savings

Mortgage Interest Calculator Cheap Sale 55 Off Www Wtashows Com

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Mortgage Calculator Chetty Builders

Mortgage Loan Calculator Lendzi

The Mortgage Center Financial Calculators Com